A ⏐ Deep Tech innovations offer solutions to profound societal challenges

What is Deep Tech and why should you be interested in it?

Deep Tech represents novel scientific/engineering breakthroughs...

...or advanced technology used to address novel customer needs.

These innovations offer solutions to profound societal challenges.

━━━━━━━━━

Deep Tech can be classified into 8 investment themes

-

Novel AI

Autonomous systems

Explainable AI

Privacy-enhancing tech

Semantic AI

-

Future of compute

Superconductors

Quantum technologies

Ambient computing

Brain-computer interface

AR/VR

-

Novel energy

Green hydrogen

Nuclear fusion

Geothermal

Next-gen solar

Waste heat recovery

-

Space tech

Launch

Earth observation

In-space manufacturing

Nanosatellites

Space mining

-

Robotics

Humanoid robots

Nanorobotics

-

Biotech, Foodtech & Agtech

Synthetic biology

Lab-grown food

AI-enabled drug discovery

Fertilizers

-

Defense tech

Cybersecurity

Drones

-

Advanced materials & nanotechnology

Green concrete

Graphene

Nanomaterial

1

/

of

8

B ⏐ 4 misconceptions about Deep Tech

-

1. Deep Tech start-ups have higher risks than traditional start-ups

Deep Tech is gradually de-risked over time resulting in similar failure and graduation rate as other tech startups.

-

2. Deep Tech life cycles are slower and have longer exit timelines

Start-ups' time to unicorn and time to exit is on par with other tech.

-

3. Deep Tech start-ups cannot scale to the same degree as oher tech start-ups

Deep Tech start-ups are more likely to scale to unicorn.

-

4. Deep Tech start-ups have lower capital efficiency than other tech start-ups

Deep Tech has greater capital efficiency.

C ⏐ First numbers suggest that European Deep Tech will likely generate outsize returns

VC funds investing in Deep Tech deliver an average net IRR above traditional tech funds.

Clear trend with Deep Tech-focused funds having outperformed traditional tech funds since 2003.

D ⏐ European Deep Tech is at an inflection point

European Deep Tech is increasingly gaining relevance both regionally and globally

Deep Tech has shown remarkable resilience in the overall VC tech downturn during the last 24 months

-

Globally

European share of global Deep Tech funding has grown from 10% in 2019 to 19% in 2023, and is set to increase further.

-

Regionally

Deep Tech funding is becoming a larger part of overall European VC tech funding, having grown from 10% of regular tech funding in 2010 to 44% in 2023.

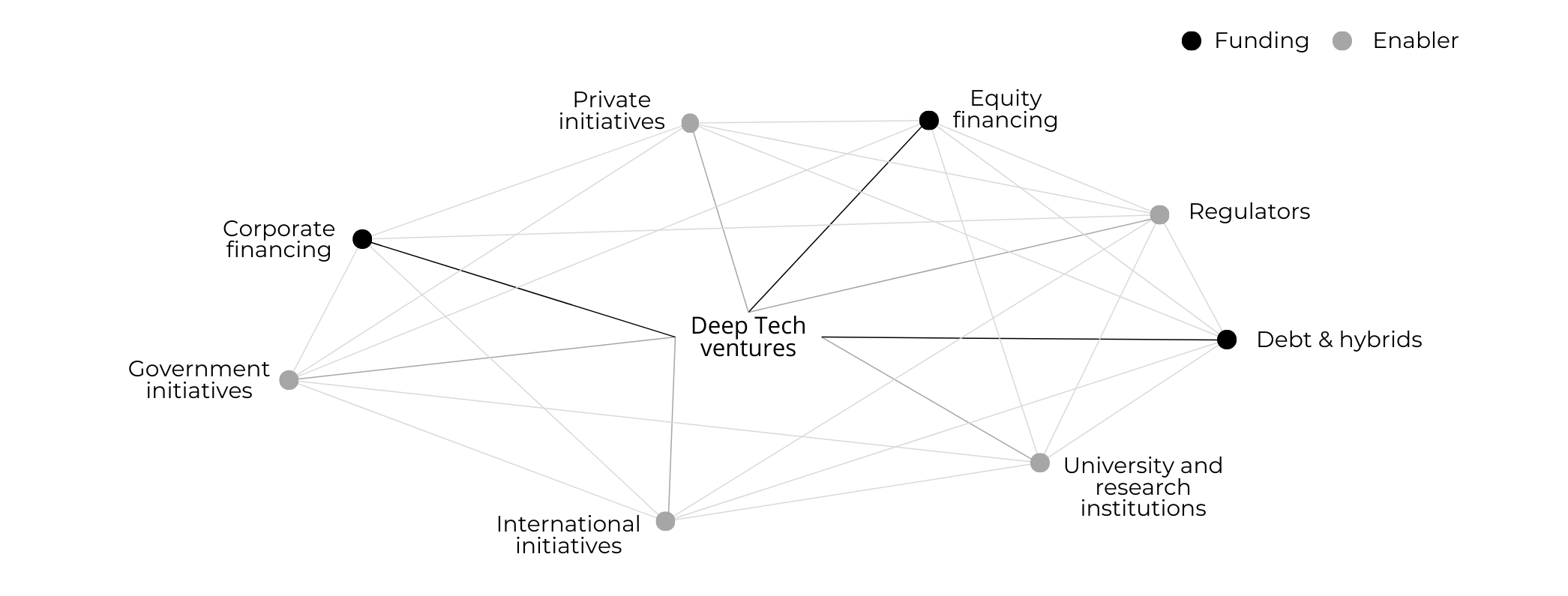

European Deep Tech need a collective effort from all actors in the ecosystem